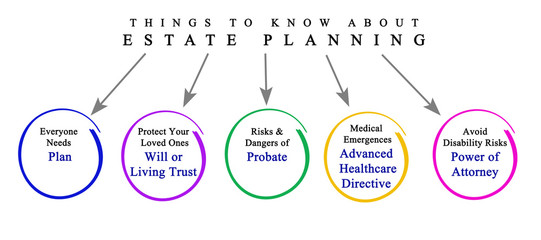

Having a complete estate plan usually involves at least four essential documents. These documents should all work together to create a comprehensive and cohesive estate plan for you and your assets which will allow peace and simplicity for your family and heirs after you pass.

Having a complete estate plan usually involves at least four essential documents. These documents should all work together to create a comprehensive and cohesive estate plan for you and your assets which will allow peace and simplicity for your family and heirs after you pass.

The Last Will And Testament

The Last Will and Testament or Will is the most commonly known document for an estate plan. Most people have a basic idea what a will is and how it works. A Will is a legal document that outlines your wishes regarding the distribution of your assets and the care of any dependents after you pass. It serves as your voice when you are no longer able to express your desires and provides clarity and direction during a time of emotional upheaval for your loved ones.

Naming A Guardian

Naming A Guardian

If you have minor children, naming a guardian is a critical component of a will. A guardian will be the person to take care of your minor children in the event of your death. This is a crucial decision that ensures your children are cared for by someone you trust and who shares your values.

Naming A Personal Representative

A will also names a personal representative which is the person that will carry out your wishes. They will be responsible for paying your debt, taxes and expenses and then distribute your assets as instructed in the Will. This role is vital for ensuring that your wishes are honored and that the process runs smoothly.

For a will to be legally enforceable, it must meet specific requirements, which can vary by state. A will must go through the probate process which allows the court to determine that the will is valid and provide authority for the personal representative to act on behalf of your estate. Many people get confused about the probate process and believe having a will avoids the probate process. This is not correct. A will must be probated to be valid and enforceable.

Everyone should have a Will. Not having a will means that your assets will be distributed according to state laws, which may not align with your wishes or intentions. The court will also decide who will be your personal representative to handle your estate. This can lead to unnecessary conflicts among family members and can delay the distribution of your estate.

The Durable General Power of Attorney

A Durable General Power of Attorney (POA) is a powerful legal document that allows you to appoint someone you trust, known as your agent or attorney-in-fact, to make decisions and take actions on your behalf. This document allows your agent to handle your financial and legal matters. This is critical in times when you may be unable to make your own decisions due to an illness, disability, accident or absence.

“Durable” simply means that the power of attorney remains effective even if you become incapacitated. Unlike a regular power of attorney which ceases to be valid when you can no longer make decisions for yourself, a durable power of attorney ensures that your agent can continue to act on your behalf when you need it the most.

The “General” part of the document means that your agent has general powers and broad authority to manage your affairs. This usually includes the power to handle financial transactions, pay bills, manage investments, file tax returns, make legal decisions, buy or sell real estate, etc. Essentially, your agent has the ability to step into your shoes and make decisions as if they were you.

Having a Durable General Power of Attorney in place in case you need it later down the road, ensures that your family or friends will not have to apply for guardianship or conservatorship if something happens to you and you can no longer make your own decisions, whether temporarily or permanently.

The Durable Health Care (Medical) Power of Attorney

A Health Care Power of Attorney (HCPOA) is a vital legal document that allows you to designate someone you trust as your agent or health care proxy to make medical decisions on your behalf if you become unable to do so yourself. This arrangement ensures that your health care preferences are honored and that your voice is heard during critical times.

A Health Care Power of Attorney (HCPOA) is a vital legal document that allows you to designate someone you trust as your agent or health care proxy to make medical decisions on your behalf if you become unable to do so yourself. This arrangement ensures that your health care preferences are honored and that your voice is heard during critical times.

By creating an HCPOA, you empower your chosen agent to make important health care decisions when you are incapacitated, whether due to illness, injury, or cognitive decline. This can include choices about medical treatments, surgeries, medications, and end-of-life care.

The HCPOA grants your agent legal authority to interact with health care providers, access your medical records, and make decisions in alignment with your wishes. This document ensures that your chosen representative has the necessary power to advocate for your health care needs. As the principal (the person granting the power), you have the right to revoke or modify the Health Care Power of Attorney at any time, as long as you are mentally competent. This flexibility allows you to adjust your agent or update your preferences as your circumstances or relationships evolve.

A Health Care Power of Attorney is an essential tool in your estate planning arsenal. It ensures that your medical preferences are honored and that your trusted representative can make informed decisions on your behalf. By taking the time to create this document, you can protect your health care rights and provide both you and your loved ones with invaluable peace of mind during uncertain times. It also avoids the need for a guardianship if you are unable to make your own decisions.

The Revocable Living Trust

A revocable living trust is another powerful tool you can use with your estate plan. The trust is a legal arrangement created during a person’s lifetime that allows them to manage their assets while still alive and to specify how those assets should be distributed after their death. The trust has three different roles within it. The Grantor or Trustor creates the trust, the trustee manages the trust and the beneficiary benefits from the trust. Usually with a revocable living trust, the grantor is also the initial trustee and beneficiary of the trust until their death.

A revocable living trust will avoid probate. The assets held in the trust will be distributed according to the instructions in the trust by the trustee of the trust. The trustee does not need authority from the court to proceed with distribution. The trustee is bound only by the instructions and terms of the trust.

A trust also remains private since it does not get recorded and does not get filed with a probate court. The details of the trust remain confidential and do not become public record. A revocable trust can be revoked or modified at any time prior to death as long as the trust maker, called a Grantor or Trustor, remains mentally capable to make changes.

The trust is also a great tool to handle incapacitation of the Grantor. The trustee or successor trustee has the authority to continue to manage the assets in the trust even after the grantor becomes mentally incapacitated and can no longer manage the assets for themself.

Beneficiary Designations or Transfer On Death Designations

Although most people need a Will and power of attorney documents, there are ways to avoid probate other than using a Living Trust. Beneficiary designations allow you to name a person to inherit your asset upon your passing automatically. These beneficiary designations can be placed on IRA’s, 401K’s, bank accounts, vehicles and even your house. There are benefits and risks involved with using beneficiary designations so be sure to speak to an attorney regarding the choice to rely on beneficiary designations and whether this decision is right for you.

The Complete Estate Plan Package…

The four documents I mentioned in this blog are the foundational documents for an estate plan. There are several other types of trusts and documents that you may need or want to utilize as you create your estate plan. Speaking with an experienced estate planning attorney can help you create the most economical and practical combination of documents to provide you and your loved ones with peace and simplicity. Click below to begin the estate planning process for your unique situation. I am happy to help you step by step through the process.